Ira withdrawal tax rate calculator

Since you took the withdrawal before you reached age 59 12 unless you met one. If you want to simply take your.

Traditional Vs Roth Ira Calculator

More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

. Multiply the taxable portion of your distribution by your state marginal tax rate to figure your state income taxes on your early IRA withdrawal. 6 1 There are currently seven federal tax. When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take.

Starting the year you turn age 70-12. Calculate your earnings and more. 10 percent for income between 0 and 19050.

Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You. With Merrill Explore 7 Priorities That May Matter Most To You. Find a Dedicated Financial Advisor Now.

When owners of a Traditional IRA reach age 72 they are required to take annual minimum distributions. Ad What Are Your Priorities. The distribution period or life expectancy also decreases each year so your RMDs will.

Use AARPs Traditional IRA Calculatorto Know How Much You Can Contribute Annually. Ad TIAA IRAs Can Give You The Flexibility And Convenience You May Need. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation.

The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. If you withdraw money from your traditional IRA before. Regardless of your age you will need to file a Form 1040 and show the amount of the IRA withdrawal.

Whenever you take money from a traditional IRA you have to pay taxes at your ordinary or marginal income tax rate. Do Your Investments Align with Your Goals. If you are under 59 12 you may also.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually.

Roth ira withdrawal tax calculator Kamis 01 September 2022 Edit. Find a Dedicated Financial Advisor Now. Unfortunately there are limits to how much you can save in an IRA.

Do Your Investments Align with Your Goals. For example if you fall squarely in. Therefore Joe must take out at least 495050 this year 100000 divided by 202.

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. 2022 IRA Minimum Distribution Tables. The amount changes each year.

This means your taxable IRA withdrawal will be taxed at 24 percent. State income tax rate. Ad Learn more about Fisher Investments advice regarding IRAs taxable income in.

Currently you can save 6000 a yearor 7000 if youre 50 or older. For married couples filing jointly the tax brackets are. Ad A Traditional IRA May Be an Excellent Alternative if You Qualify for the Tax Deduction.

Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation. With a traditional IRA withdrawals are taxed as regular income not capital gains based on your tax bracket the year of the withdrawal.

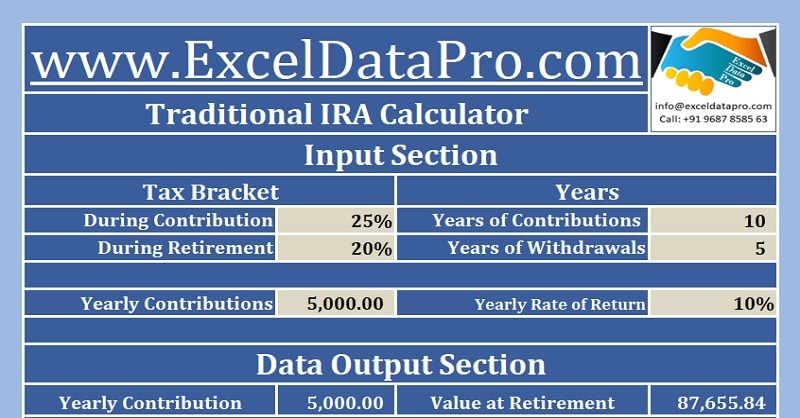

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Roth Ira Calculator Roth Ira Contribution

Download Free Traditional Ira Calculator In Excel

Traditional Vs Roth Ira Calculator

Roth Ira Conversion Calculator Excel

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Roth Ira Calculator Excel Template For Free

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Download Traditional Ira Calculator Excel Template Exceldatapro

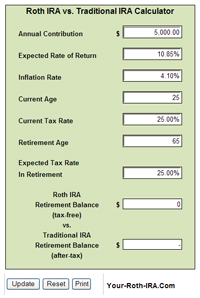

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Best Roth Ira Calculators

Download Traditional Ira Calculator Excel Template Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Ready To Use Traditional Ira Calculator 2021 Msofficegeek

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro