Student loan forgiveness

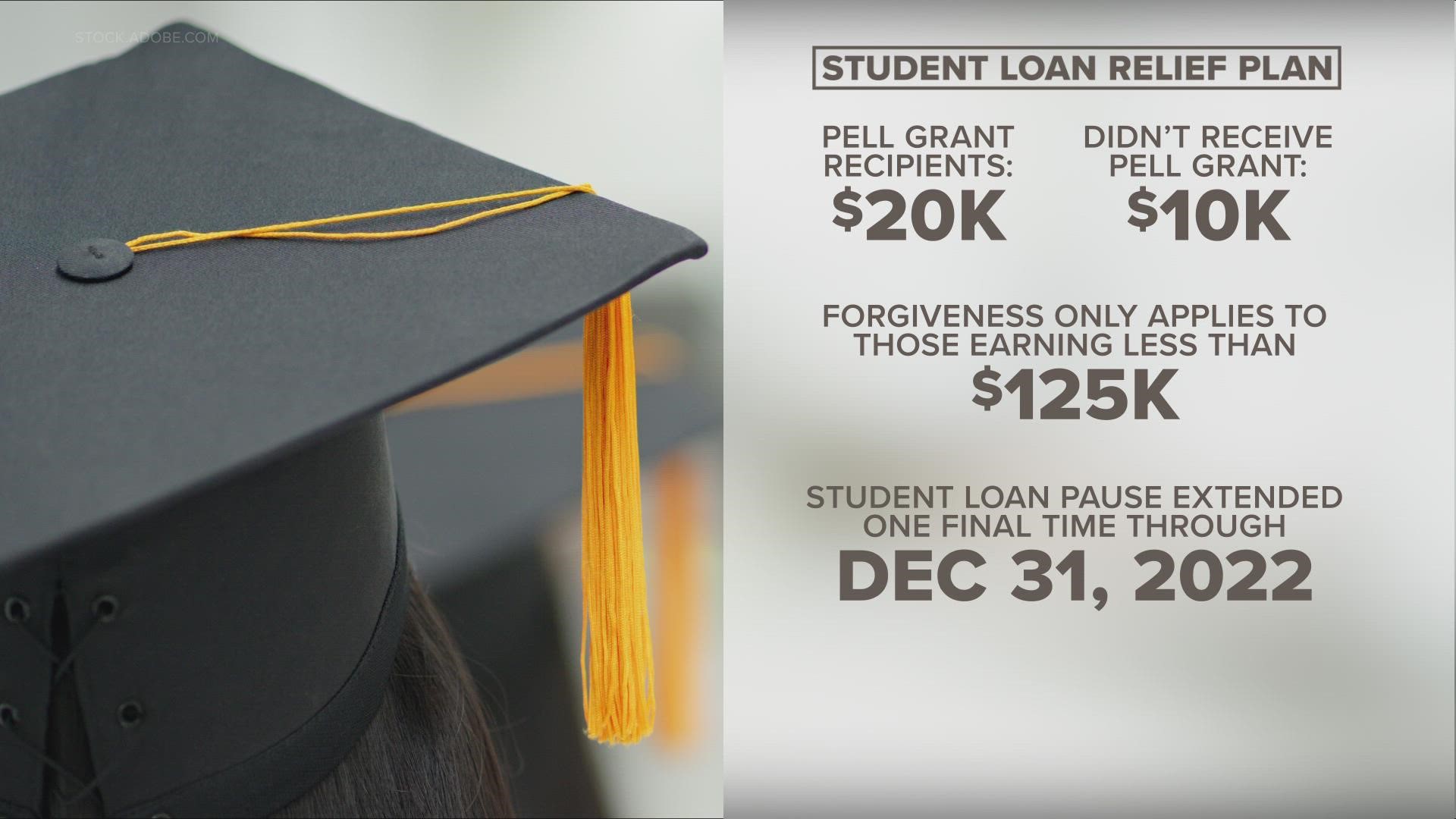

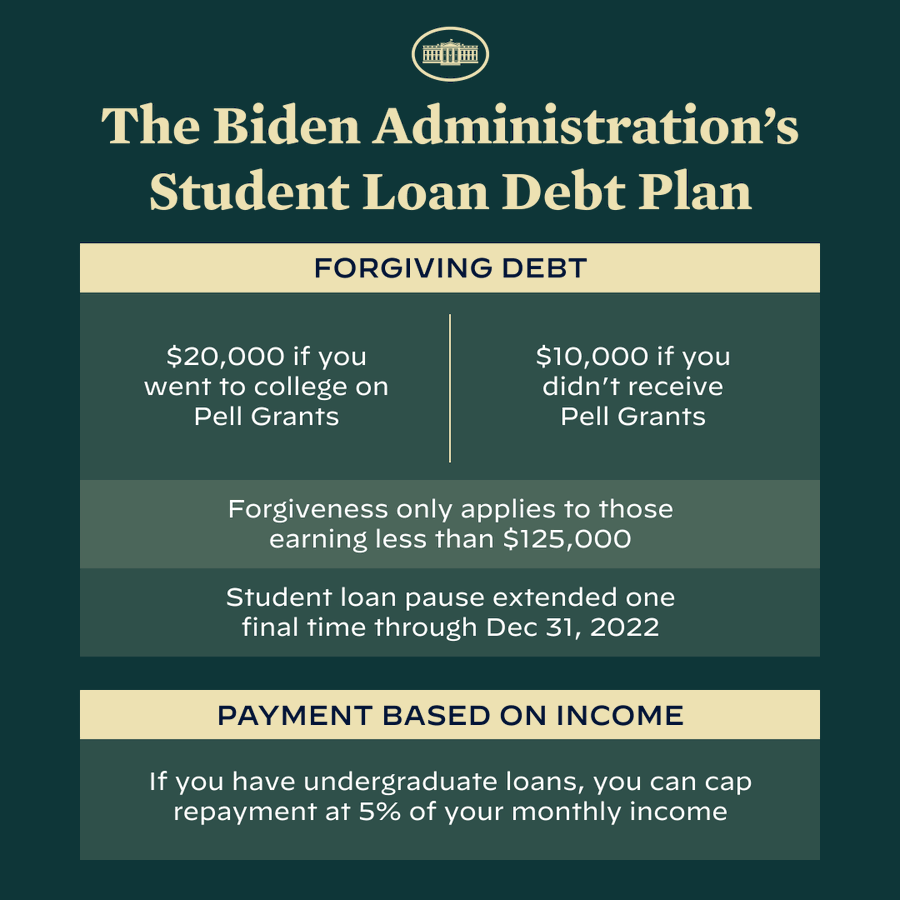

23 is looking to be the soonest date the Department of Education can begin canceling student loan debt. Borrowers can qualify for debt forgiveness based on their income in either the 2020 or 2021 tax year.

Thanks To Union Advocacy Student Loan Forgiveness Is A Reality

Tax-free Student Loan Forgiveness.

. Student Loans Forgiveness. The Biden administration crafted its student debt forgiveness proposal in an attempt to avoid benefiting the wealthiest families. Contact Your Loan Servicer QuestionsMake a paymentLoan balance.

The possible new date appears in a court document for a lawsuit. Before the pandemic you paid around 320 a month on a 10-year repayment term. A US district judge could decide soon whether to temporarily block President Joe Bidens student loan forgiveness program from taking effect after hearing a motion for a.

Student Loans Forgiveness. Since President Biden announced his student loan forgiveness plan the reaction has been predictable and political. If you made federal student.

If you get 10000 in student loan forgiveness your total balance would be reduced by a third. Thats because the Education Department is saying it will take up to. I am very grateful for this watershed.

So if you earned 120000 in 2020 but got a big raise in 2021 you still. August 26 2021 Extended Closed School Discharge Will Provide 115K Borrowers from ITT Technical Institute More Than 11B in Loan Forgiveness Today the US. You must have at least 10000 in federal loans to qualify though thats a pretty.

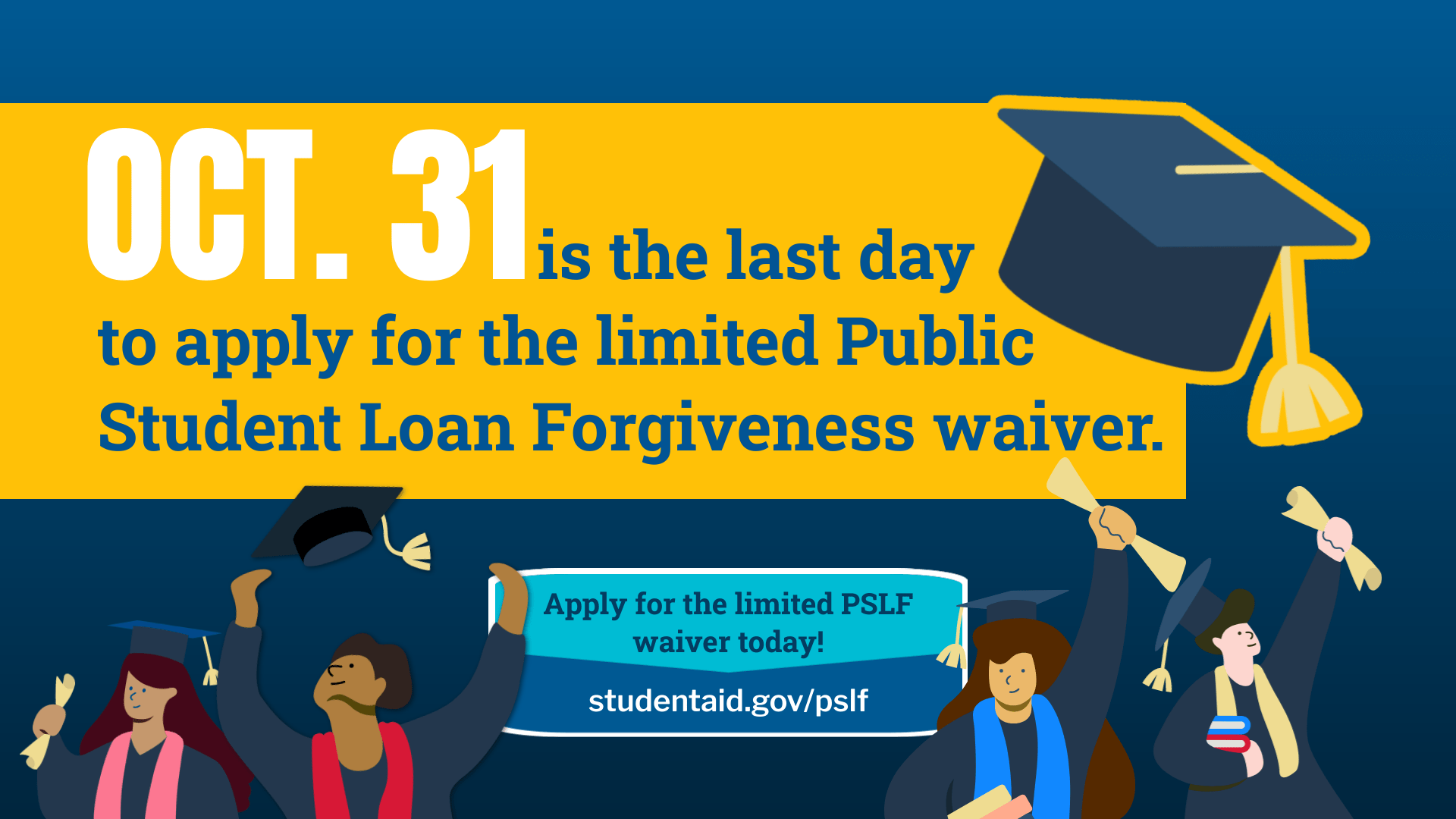

If you work there for at least three years youll receive up to 60000 in loan forgiveness. Federal student loan borrowers should aim to apply for forgiveness no later than Nov. To be eligible for 10000 in loan.

The American Rescue Plan Act of 2021 included. Login to My Federal Student Aid Federal student. Before you need to even worry about applying for student loan forgiveness under the Biden administrations new plan youll need to make sure you actually qualify.

Student loan interest payments are reported on the IRS Form 1098-E Student Loan Interest Statement. The Biden administration on Thursday is kicking off its efforts toward forgiving student loan debt sending updates on the process via email before the window to apply opens. Congress also took action concerning the tax treatment of student loan debt forgiveness.

Federal Student Loan Forgiveness Your Questions Answered Best Colleges U S News

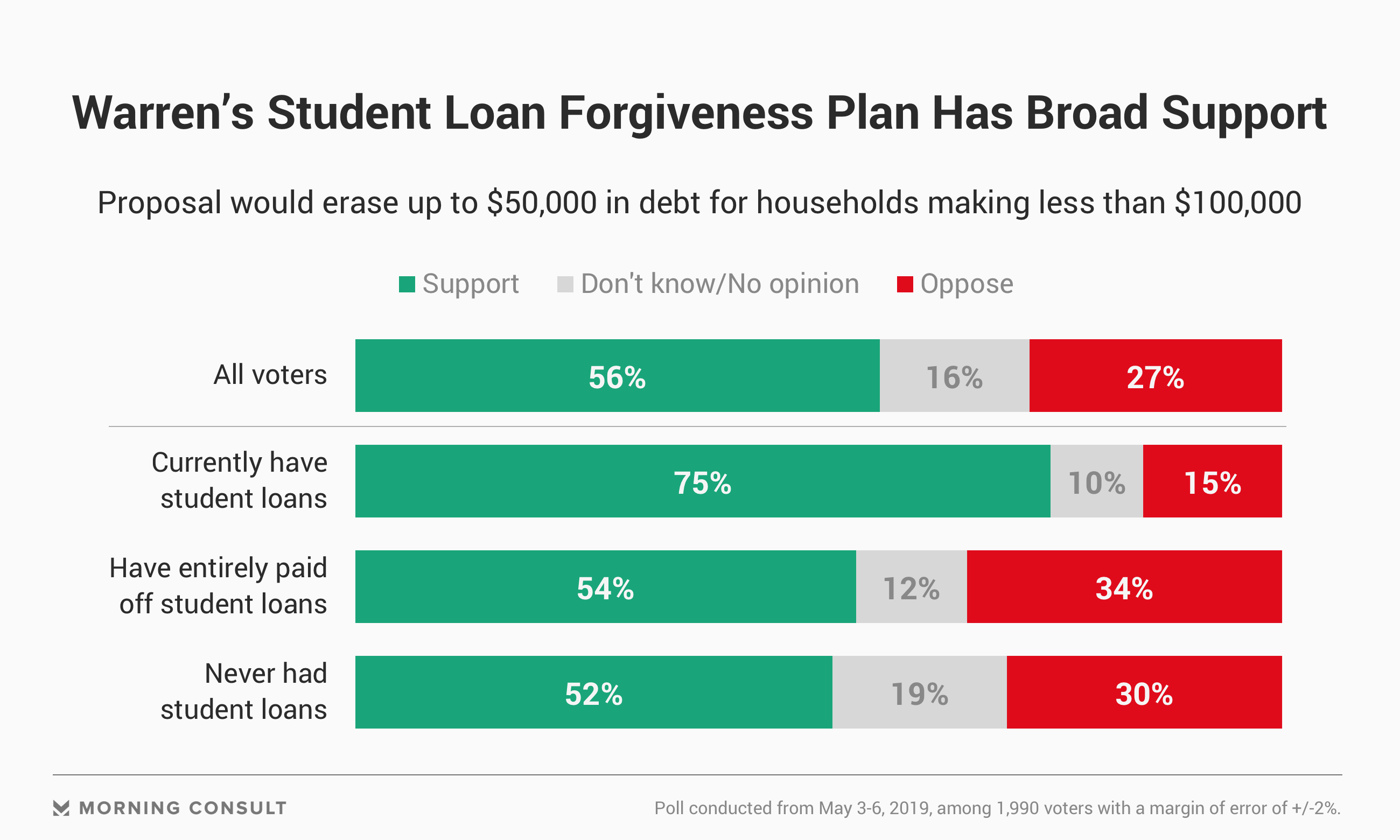

Elizabeth Warren S Student Debt Forgiveness Plan Popular With Voters

Fsr9jddrk 0iim

Examining 3 Of The Arguments Of The Student Loan Forgiveness Debate Npr

/cloudfront-us-east-1.images.arcpublishing.com/gray/3GWFIVWP2BEZTFQBD5PQ5KVZEY.jpg)

Beta Testing Begins Of Student Loan Forgiveness Application

Student Loan Forgiveness Zoom Workshops Ohio Education Association

Which States Tax Student Loan Forgiveness And Why Is It So Complicated Tax Policy Center

Putting Student Loan Forgiveness In Perspective How Costly Is It And Who Benefits

Joe Biden Could Have Gone A Lot Further On Student Loans Mr Online

President Biden Announces Student Loan Forgiveness Abc News

St Louis Groups React To Student Loan Debt Forgiveness Rollout Ksdk Com

Important Student Loan Forgiveness Program Changes Are Here

Student Loan Forgiveness Will Benefit Some But Leaves Others Hesitant

Dsqyhbj6zkm4km

35xmtd3wkhe Jm

Public Service Loan Forgiveness Program Forbes Advisor

And Now What The Question That Followed Biden S Student Loan Forgiveness Plan Npr